If you have any questions or dificulities manging your business website, just reach out to our Customer Success Managers!

What are the Expenses in VEVS Car Rental Software?

The term expenses refers to any cost incurred by the business in the process of renting out vehicles to clients and operating the rental service. These expenses can vary depending on the scale of the operation and the specific services offered, but here are some of the most common expenses as listed in the VEVS car rental business software:

Maintenance and Repairs: Regular maintenance and occasional repairs are necessary to keep the rental vehicles in good condition. This includes costs for oil changes, tire replacements, part replacements, engine repairs, and more.

Fines: This includes fines applied by law enforcement such as “Talking on the phone”, Tickets, Parking Tickets or Speeding Tickets.

Other Expenses:

Taxes: This includes income taxes, property taxes, and other taxes levied on the business.

Cleaning and Detailing: Cleaning, washing, and detailing the vehicles between rentals is an operational expense.

Insurance: Car rental businesses must carry insurance to protect against potential accidents, damage to the vehicles, and liability claims. Insurance premiums are an ongoing expense.

Location and Facilities: Renting or leasing office space, parking lots, and rental counters is an expense. This includes rent or lease payments, utilities, and maintenance.

Licensing and Permits: Car rental businesses typically require various licenses and permits, which can come with fees and renewal costs.

How can the Expenses function help my car rental business?

Recording vehicle expenses in VEVS Car Rental Software can significantly benefit car rental companies in managing their fleet and overall business. Here's how:

Budgeting and Forecasting: By tracking expenses, companies can create accurate budgets and financial forecasts. Knowing the regular costs associated with each vehicle helps in predicting future expenses and setting rental prices accordingly.

Maintenance Scheduling: Regularly recording expenses in the car rental management system can highlight when a vehicle often requires repairs or maintenance. This can help schedule timely maintenance, ensure vehicles are always in optimal condition, and reduce long-term repair costs.

Vehicle Performance Analysis: By comparing expenses across different vehicles, car rental companies can identify which vehicles are more cost-effective and which ones have higher maintenance or fuel costs. This can influence future purchasing decisions.

Cost Control: Regularly monitoring of the expenses using the car rental software can help identify any sudden spikes in costs, allowing for immediate corrective action. For instance, if maintenance costs for a particular vehicle are higher than average, it might indicate inefficient usage or a mechanical problem.

Decision-making: Data-driven decisions are always more effective. By analyzing expense trends, companies can make informed decisions about fleet expansion, vehicle replacements, or discontinuations.

Operational Efficiency: Understanding where the money is being spent can lead to operational improvements. For instance, if cleaning costs are high, the company might consider in-house solutions rather than outsourcing.

Incorporating a systematic approach to recording and analyzing vehicle expenses with the VEVS Car Rental Software can lead to more efficient operations, cost savings, and a better understanding of the business's financial health.

How to add an expense for a vehicle?

To add a vehicle expense, let’s first open the Expenses menu by following the steps below:

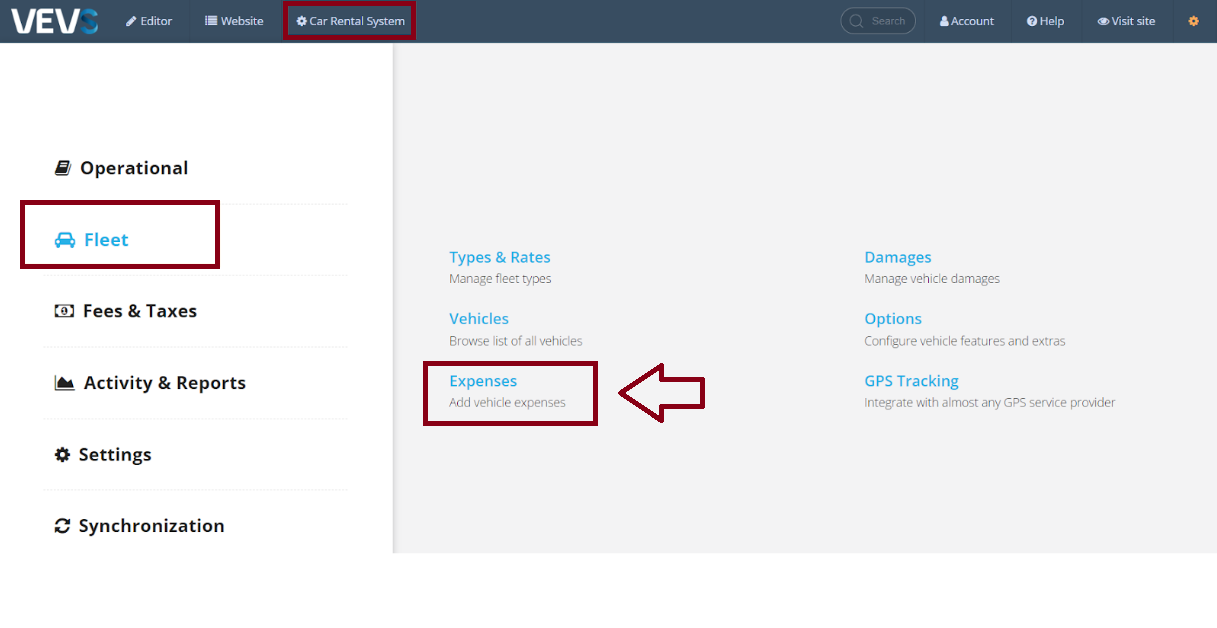

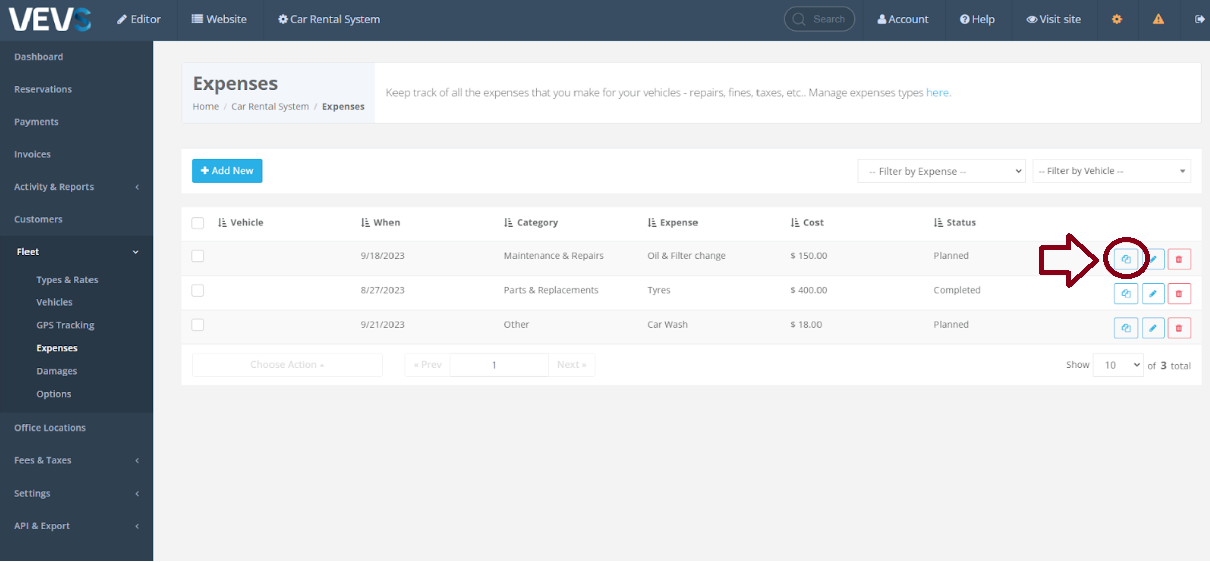

1.) Go to Car Rental Software, navigate to “Fleet”, and then select “Expenses” from the right-hand side.

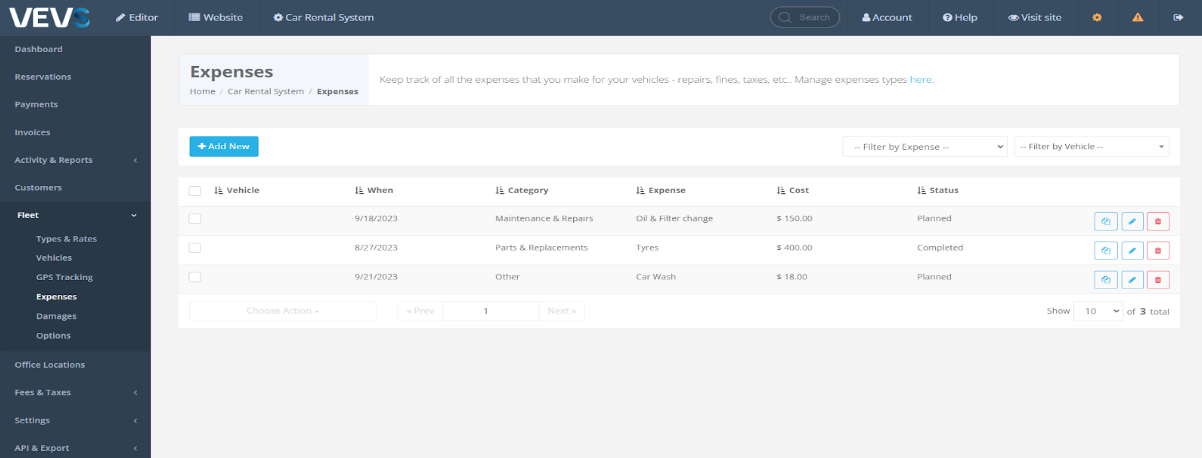

2.) Then, you will be taken to the following screen, which you can use to view the list of all of your Expenses. You can also use this menu to modify any expenses or even “Copy” an expense from one vehicle to another.

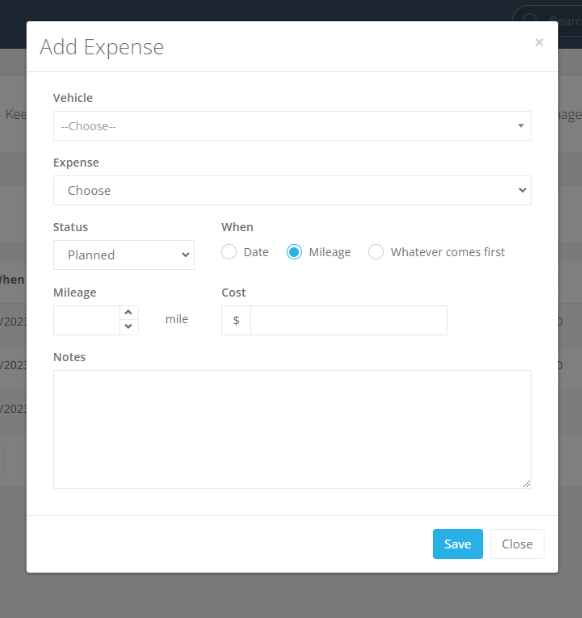

3.) Let’s click on “+ Add New” to create an expense. Once you click on it, you will have a pop-up screen showing you the multiple options to select and fields to fill out about your expense. Let’s go over what each section is about:

Vehicle: Select the vehicle that the expense is for.

Expense: Select the type of expense recorded.

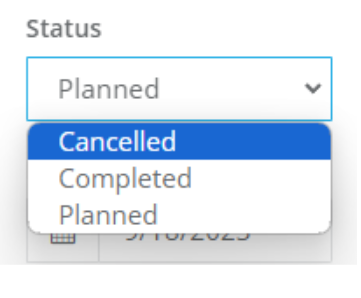

Status: Select the current status of the expense. The options are Cancelled, Completed & Planned.

When: Select when the expense is going to be taking action. You can set it to be a Date, at a specific Mileage in your vehicle or the 3rd option, “Whatever comes first”.

Mileage: If you selected the “Mileage” option in the “When” section, this will set the mileage to when the Expense should happen.

Cost: The cost of the recorded Expense.

Notes: An empty field for you to write any notes you might feel are necessary about the recorded Expense.

How do you schedule an expense?

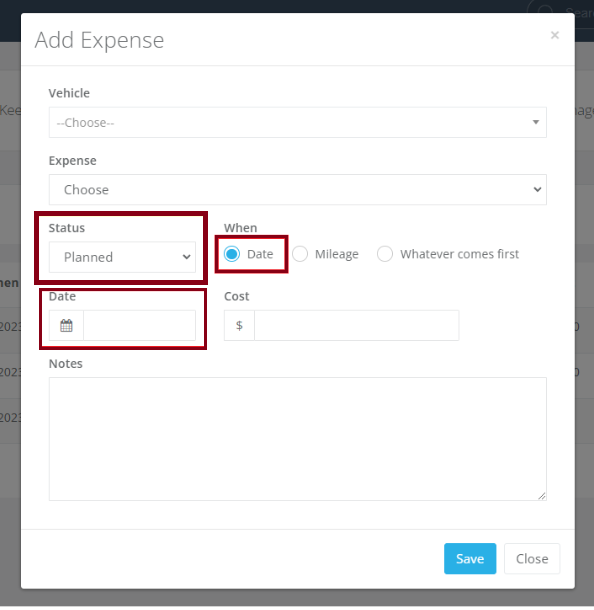

To schedule an expense, let’s go to the “+ Add New” button and configure the expense. Simply click on “Planned” in the “Status” section and then select “Date” in the “When” section next to it. Now, just choose the date of your choice for when the expense will happen. See the image below, which should be the selected options alongside the date of choice.

How do you manage the Expenses list?

In order to add, edit or remove an expense type to our total expenses list, we must go to the following menu:

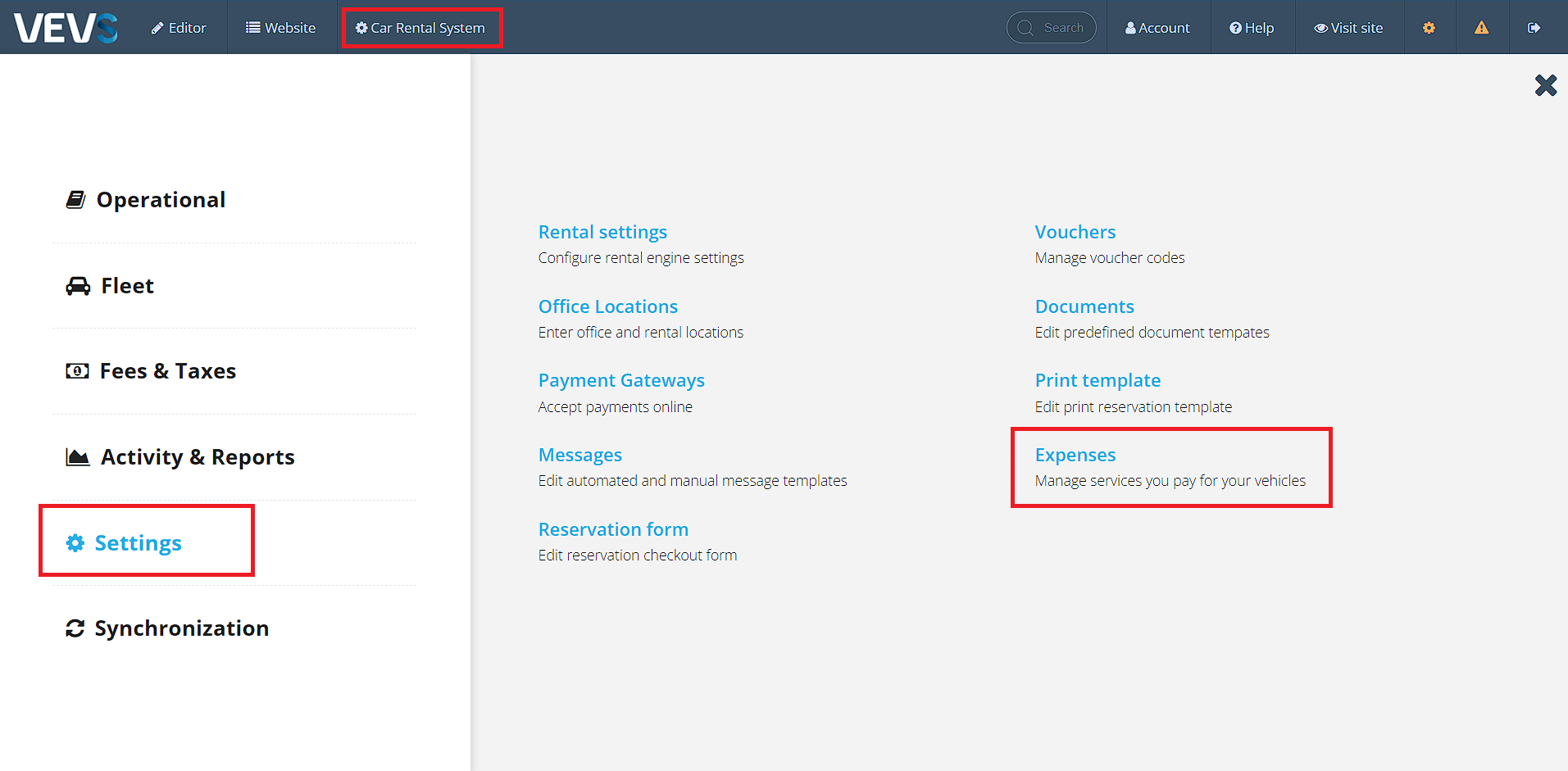

- Log into your VEVS Car Rental website and go to Car Rental System on the top left.

-

Select ”Settings” on the left and then “Expenses” on the right. See the image below for reference:

-

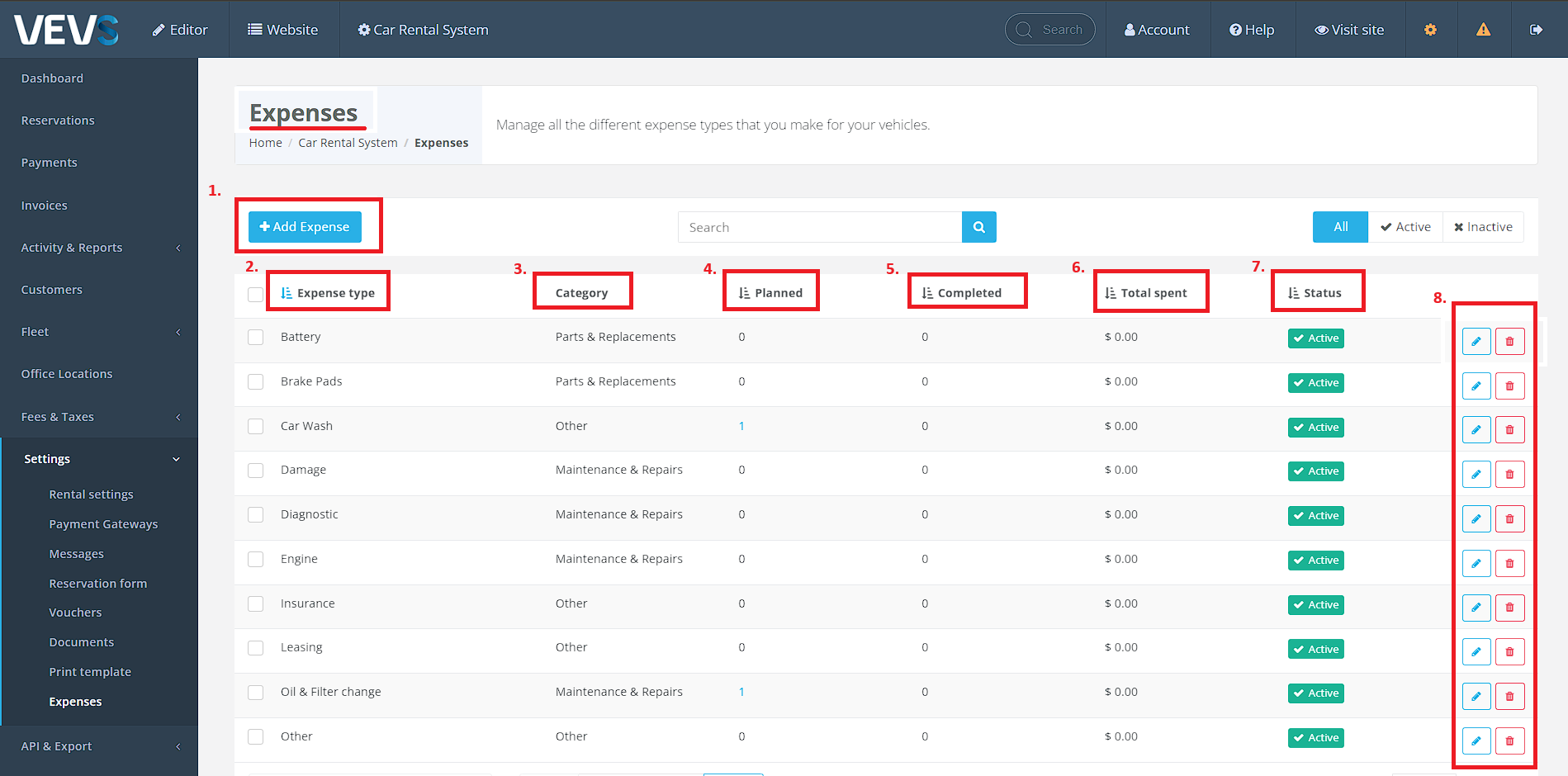

Once you click on Expenses, you will see the following interface, see below the purpose of each field in the grid:

- Add Expense - Use this button to add a NEW expense.

- Expense Type - This is the Expense Type, you will see the NAME of the expense here.

- Category - This is the Category of the expense, you may put multiple Expense Types under a Category.

- Planned - This is where you will see how many expenses are currently planned for that specific Expense Type.

- Completed - This is where you will see how many expenses are completed for the specific Expense Type.

- Total Spent - Total amount of money spent on that specific Expense Type for all vehicles.

- Status - The status of the Expense Type, you can have it as inactive or active. When an Expense Type is inactive, you will not be able to use it to record an expense for any vehicles.

- These are your EDIT and DELETE buttons for the Expense Types. Use them to modify or delete an Expense Type.

How to “Copy” an expense?

To copy an Expense from one vehicle to another, simply go to the Main Expenses menu and click on the “Copy Expense” button on the right side of the desired Expense.

See the image below as reference.

What does the “Status” in the Expense details mean?

The “Status” section in the Expense refers to the current condition of said “Expense”.

Cancelled: The Expense is cancelled or did not take effect.

Completed: The Expense happened successfully and took effect.

Planned: The Expense hasn’t happened yet, but it is scheduled to take place in the future.

A complete history of the Expenses you make per Vehicle

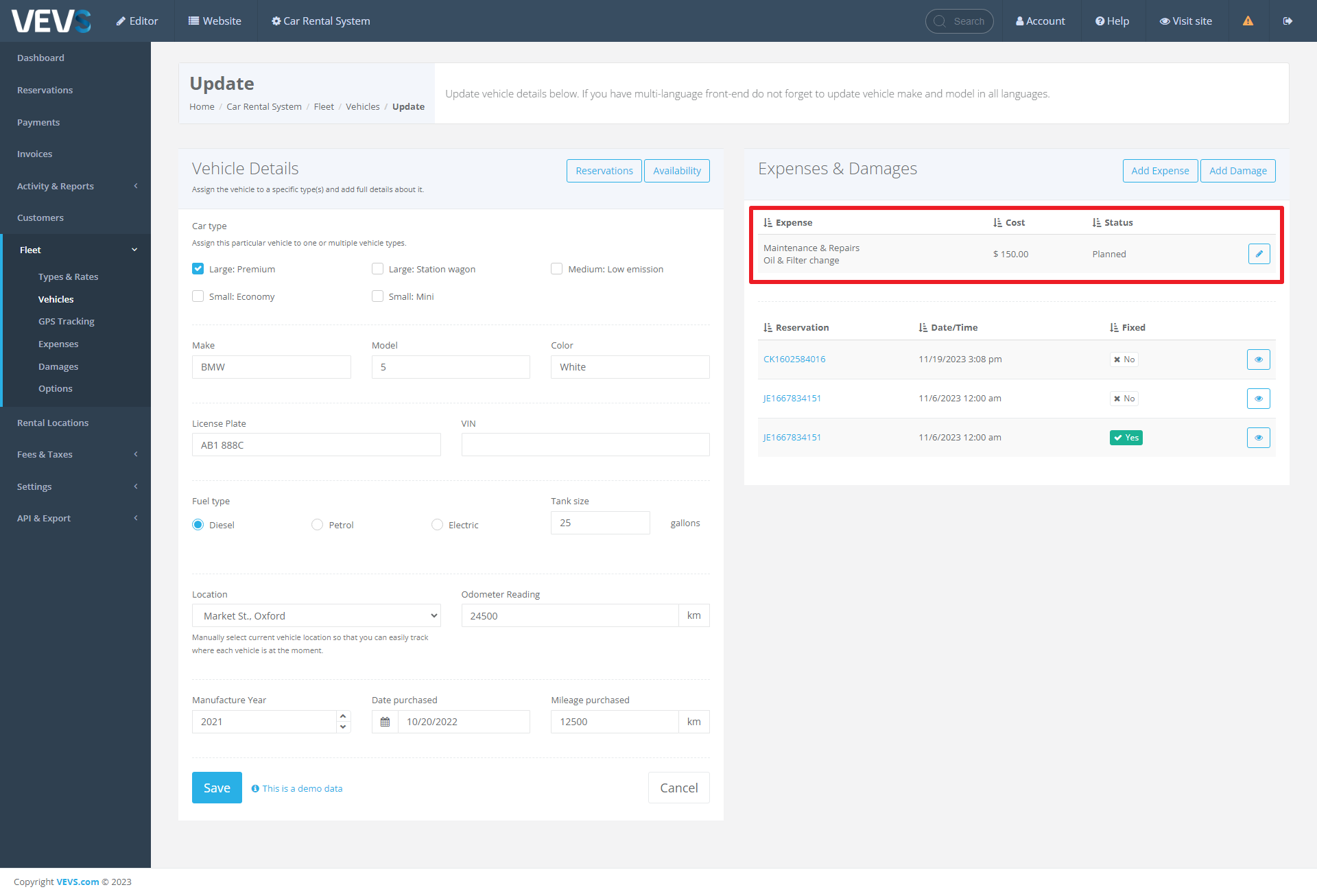

On the "Edit Vehicle" screen, the Car Rental System offers an exhaustive record of expenses incurred for each vehicle, providing transparent financial tracking on a vehicle-by-vehicle basis.

The "Expenses & Damages" section lists specific services or maintenance tasks, such as "Maintenance & Repairs" and "Oil & Filter change," along with the associated costs - for example, for the BMW 5 Series that is shown in the screenshot above the maintenance and repairs cost $150.00.

The status column indicates the current state of the expense, with entries such as "Planned," allowing the user to see both forecasted expenses and those already incurred.

Conclusion

This Expense functionality facilitates effective budgeting and financial management by keeping a precise log of all costs related to the upkeep of each vehicle in the fleet. It is an invaluable tool for monitoring the financial aspects of vehicle maintenance and ensuring that each vehicle is maintained within its budgeted parameters.